Behavioral risk profiling and assessment

AI-powered portfolio optimization

Real-time suitability recommendations

AI-powered recommendations, multilingual client service, and automated compliance for serving Canada's diverse communities.

Canadian advisors trust WealthBridge360 to serve their multicultural clients with personalized, AI-powered investment solutions.

Compliance rate achieved through our embedded compliance module that automatically flags high-risk allocations and ensures regulatory adherence.

WealthBridge360 is a white-labeled SaaS platform designed to empower small and mid-sized wealth managers, independent financial advisors, and multicultural financial service firms in Canada. We enable advisors to deliver compliant, personalized, and AI-powered investment services tailored to underserved investor segments, especially newcomers and multicultural high-net-worth individuals.

Our behavioral-driven AI suitability engine provides personalized investment recommendations based on comprehensive client profiling and risk assessment.

Break language barriers with our multilingual client interface supporting Hindi, Mandarin, Punjabi, and other languages to serve diverse Canadian communities.

Built-in compliance module automatically flags high-risk allocations and ensures regulatory adherence, giving advisors confidence in every recommendation.

Our white-labeled SaaS platform delivers cutting-edge technology solutions designed specifically for wealth managers and financial advisors serving multicultural Canadian communities. Transform your practice with AI-powered tools and compliant investment services.

Our platform combines cutting-edge AI technology, comprehensive compliance frameworks, and multicultural accessibility to deliver unparalleled value to Canadian wealth managers and their diverse clientele.

Transform client interactions with behavioral-driven investment recommendations powered by advanced AI algorithms. Deliver personalized portfolio suggestions based on comprehensive risk profiling and client objectives.

Behavioral risk profiling and assessment

AI-powered portfolio optimization

Real-time suitability recommendations

Empower your advisory practice with AI-driven suitability assessments, culturally-aware recommendations, and seamless multilingual client communication designed to serve Canada's diverse communities with confidence and precision.

Native language client communication

Cultural investment preferences integration

Multicultural client onboarding flows

Protect your practice with automated regulatory compliance monitoring. Our embedded system ensures every recommendation meets Canadian financial regulations, reducing liability and building client trust through transparent compliance processes.

Real-time regulatory compliance monitoring

Automated audit trail generation

High-risk allocation alerts and flagging

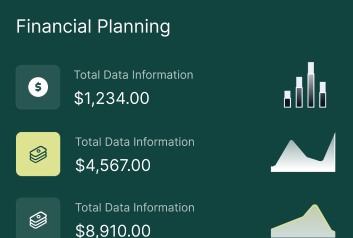

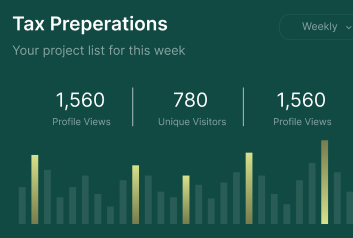

Streamline your practice management with a comprehensive dashboard featuring real-time client insights, portfolio analytics, and integrated workflow tools designed specifically for Canadian wealth advisors serving multicultural clients.

Real-time client portfolio tracking

Integrated client communication tools

Performance analytics and reporting

Our team of experienced professionals delivers personalized, results-driven financial strategies tailored to your unique goals. We prioritize transparency, trust, and long-term success.

We believe that a successful financial journey starts with understanding your unique needs and aspirations Our approach is built on a foundation of collaboration, transparency, and expertise.

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today's finance landscape, making it easier to navigate your financial journey.

Behavioral-based investment recommendations powered by advanced AI algorithms for personalized client portfolios.

Serve multicultural clients in Hindi, Mandarin, Punjabi, and other languages with seamless cultural understanding.

Automatic risk flagging and regulatory compliance monitoring to ensure adherence to Canadian financial regulations.

Choose the perfect plan for your advisory practice. Our flexible pricing scales with your client base, ensuring you get maximum value while serving multicultural Canadian investors.

Starter

Perfect for independent advisors starting to serve multicultural clients. Get access to basic AI recommendations, 5 languages, and essential compliance features.

Professional

Ideal for growing advisory practices. Advanced AI engine, 10+ languages, premium compliance monitoring, and priority support for expanding client bases.

Enterprise

Comprehensive solution for large wealth management firms. Full AI suite, 15+ languages, white-label customization, dedicated support, and enterprise integrations.

Start your journey toward financial success with expert guidance and personalized solutions. Secure your future with confidence.

Our AI engine analyzes client behavior, risk tolerance, and financial goals to generate personalized investment recommendations that align with individual preferences and objectives.

WealthBridge360 supports multiple languages including Hindi, Mandarin, Punjabi, and other languages to serve Canada's diverse multicultural communities effectively.

Our embedded compliance module automatically monitors all investment recommendations and flags high-risk allocations to ensure adherence to Canadian financial regulations.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.